5 Types of Adjusting Entries

In the previous article we talked about the accounting cycle. Adjusting entries that convert assets to expenses.

Adjusting Entries Definition Types Examples

Adjust Plant and Equipment Assets.

. Subscriptions gift cards and yearly memberships are examples of this revenue type. And to prepare adjusted trial balance we need to make adjusting journal entries. When you generate revenue in one accounting period but dont recognize it until a later period you need to make an accrued revenue adjustment.

Youve already earned revenue but you cant recognize it until the sales invoice is processed. Adjusting entries can be divided into the following four types. Adjusting Prepaid Assets Accounts.

Adjusting journal entries are a feature of accrual accounting as a result of revenue recognition and matching principles. Prepaid Expense expenses paid but not yet incurred. In the few years since the introduction of the first digital device we have learned a lot about how to adjust the.

There are 5 types of Adjustments. Subscriptions gift cards and yearly memberships are examples of this revenue type. When you generate revenue in one accounting period but dont recognize it until a later period you need to make an accrued revenue adjustment.

Adjusting entries are prepared for the following. This is miscellaneous assets that are paid for in advance. The five types of adjusting entries.

Some cash expenditures are made to obtain benefits for more than one accounting period. One of the steps is to prepare adjusted trial balance before making financial statements. There are only five of them and its easy to figure out what is the main difference between them all.

What types of adjusting entries exist. The three most common types of adjusting journal entries are accruals deferrals and estimates. Adjusting journal entries can be classified into three main types.

Determine current account balance. Prepaid expenses money paid in advance for unused yet assets. Deferred revenue often refers to advance payments a company receives before delivering goods or services.

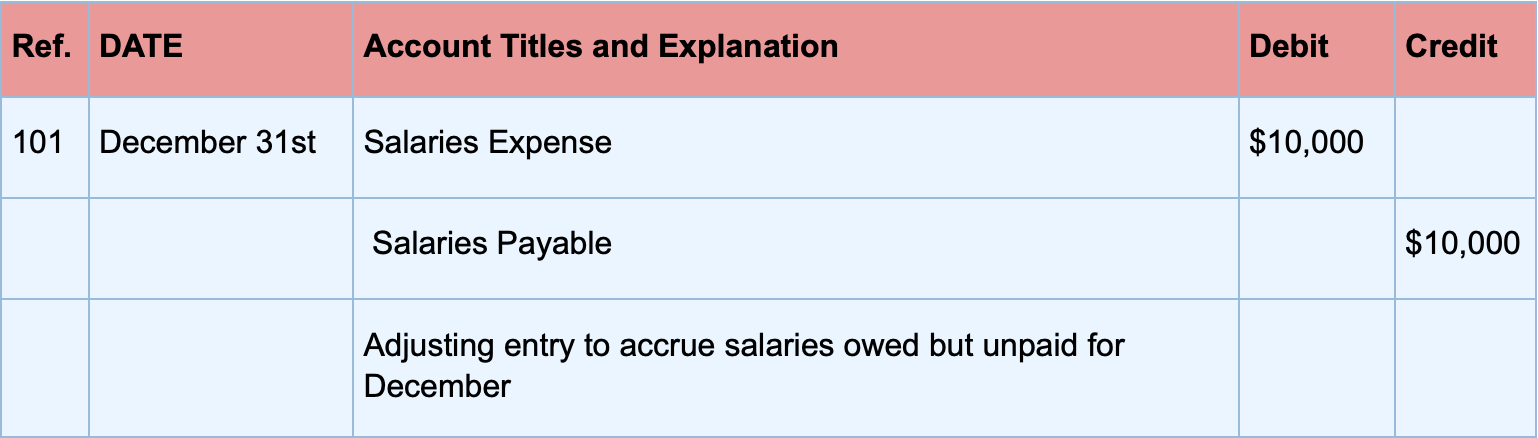

In all the examples in this article we shall assume that the adjusting entries are made at the end of each month. Accrued Expense expenses incurred but not yet paid. Lets describe all the types of adjusting entries you can come across.

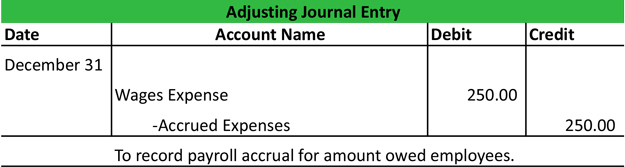

To make an adjusting entry for wages paid to an employee at the end of an accounting period an adjusting journal entry will debit wages expense and credit wages payable. Here are the three main steps to record an adjusting journal entry. Some common types of adjusting journal entries are accrued expenses accrued revenues provisions and deferred revenues.

The five types of adjusting entries. The five following entries are the most common although companies might have other adjusting entries such as allowances for doubtful accounts for example. Deferred revenue often refers to advance payments a company receives before delivering goods or services.

There are five main types of adjusting entries that you or your bookkeeper will need to make monthly. Determine what current balance should be. What Are The 5 Types Of Adjusting Entries.

2 Accrued Expenses. Types of Adjusting Entries. How to Record Adjusting Entries.

Learn vocabulary terms and more with flashcards games and other study tools. Wages paid to an employee is a common accrued expense. Classification of Adjusting Entries.

Deferred Income income received but not yet earned. All five of these entries will directly impact both your revenue and expense accounts. There are five types of adjusting entries such as.

Types of Adjusting Entries. Types and examples of adjusting entries. Start studying 5 types of adjusting journal entries.

Unearned revenues income business received in advance that is. Learn vocabulary terms and more with flashcards games and other study tools. Convert assets into expenses.

Adjust Unearned Revenue Account. In respect to this what are the five types of adjusting entries. The following are five common types of adjusting entries that a business may use.

Accrued Income income earned but not yet received. If you perform a service for a customer in one month but dont bill the customer until the next month you would make an adjusting entry showing the revenue in the month you. Generally there are 4 types of adjusting entries.

Start studying 5 types of adjusting entries accrual. Recording AJEs is quite simple. These adjustments are then made in journals and carried over to the account ledgers and accounting worksheet in.

The following are five common types of adjusting entries that a business may use. You can use an adjusting journal entry for accrual accounting when accounting periods transition.

6 Types Of Adjusting Entries Explanation With Example Tutor S Tips

Bookkeeping Adjusting Entries Reversing Entries Accountingcoach

Adjusting Entries Meaning Types Importance And More

Four Types Of Adjusting Entries Accounting Basics Accounting And Finance Learn Accounting

Adjusting Entries Types Example How To Record Explanation Guide

What Are Adjusting Entries Definition Types And Examples

0 Response to "5 Types of Adjusting Entries"

Post a Comment